CLOSE

Specials

- Trading Solutions APAC

- Wealth Management MENA

- CPA Firms Canada

- Financial Risk Management APAC

- Investment Banking APAC

- Corporate Advisory APAC

- Regtech APAC

- Escrow Services

- Digital Banking Latam

- Investment Advisory APAC

- Treasury Management Europe

- RegTech Europe

- Financial Risk Management Europe

- Mortgage Broker

- Financial Licensing Europe

- RIA Advisory Europe

- FinTech Canada

- Financial Asset Management APAC

- Financial Health Europe

- Trading

- Investment Services Europe

- Lending Mangment Latam

- Payment Solution Europe

- Broker Dealer Firms Canada

- Alternative Investments Canada

- Financial Fraud

- Investment Management Latam

- Investment Banking Canada

- Lending Management

- Payment Solution

- Proprietary Trading Europe

- Wealth Management

- FinTech

- Financial Brokerage Firm APAC

- Investment Advisory Europe

- Claim Adjusting

- Claim Adjusting APAC

- Mergers and Acquisitions Consulting APAC

- Equipment Financing

- CPA Firms

- Mergers and Acquisitions Consulting Canada

- Investment Services

- Valuation Services Canada

- Wealth Management APAC

- Broker Dealer Firms

- Debt Collection Agencies

- Mergers and Acquisitions Consulting

- FinTech Europe

- Fintech Latam

- Financial Planning / Retirement

- Investment Management

- Financial Compliance

- Payment and Card Latam

- Financial Marketing

- Investment Services Latam

- Digital Insurance Europe

- Alternative Investments

- Trading Solutions Europe

- Tax Advisory Canada

- Mergers and Acquisitions Consulting Latam

- Wealth Management Latam

- Digital Banking Europe

- Business Loan

- Financial Portfolio Management Canada

- Financial Restructuring Europe

- Mergers and Acquisitions Consulting Europe

- Wealth Management Europe

- Debt Collection Agencies Europe

- CFO Services

Weekly Brief

×Be first to read the latest tech news, Industry Leader's Insights, and CIO interviews of medium and large enterprises exclusively from Financial Services Review

Thank you for Subscribing to Financial Services Review Weekly Brief

Navigating the Complexities of Credit Card Processing

Credit card payment processing should be a regular aspect of any business operation rather than a cause for anxiety.

By

Financial Services Review | Monday, June 03, 2024

Stay ahead of the industry with exclusive feature stories on the top companies, expert insights and the latest news delivered straight to your inbox. Subscribe today.

For small business owners, the ideal credit card processor offers dependable, secure, and cost-effective services that require minimal attention.

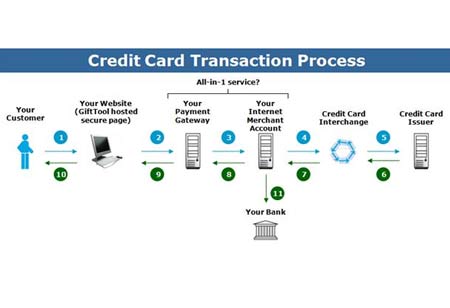

Credit card payment processing should be a regular aspect of any business operation rather than a cause for anxiety. It is customary for credit card processors to levy a processing fee on each credit card transaction that a business accepts. There may be additional fees charged depending on the pricing model utilized by your processor and the type of processor you have.

Processing fees are charges imposed by a company or service provider to cover the transaction's cost. These fees are typically applied to credit card transactions but may also be applied to other transactions, such as bank transfers or online payments. Transaction types, amounts, and vendors can influence processing fees. Payment processing fees should be carefully reviewed before agreeing to them.

Credit card processing fees come in three distinct types.

The interchange fee is a fee merchants pay card-issuing banks to accept card-based transactions. The interchange fee refers to the wholesale fee. The fee in question is a fixed and mandatory charge encompassing the expenses of handling the transaction, the potential hazards of payment authorization, and the risks of fraudulent activities and unpaid debts. The interchange fee, a combination of a percentage of the purchase total and a fixed transaction fee, is levied by the card network and collected by the consumer's issuing bank. The costliest aspect of processing credit card payments is the fee, usually influenced by credit card type. Typically, U.S. credit cards have an average interchange rate of around 1.8 percent, while debit cards have an average rate of 0.3 percent. Despite this, it's important to note that the actual rate a merchant will be charged can vary significantly. Typically, premium or rewards cards tend to have higher interchange fees.

An assessment or service fee may be charged for certain products or services. This fee is considered non-negotiable and is charged by the card network. The fee card networks charge is usually a nominal percentage subject to fluctuations based on your transaction volume and risk assessment.

A processing fee is a charge assessed by a company or organization to cover the cost of handling a transaction or application. Many industries practice it, including finance, real estate, and government services. The processing fee may be flat based on the total transaction amount and is typically non-refundable. Customers should be aware of any processing fees associated with their transactions and factor them into their budget accordingly. Every payment processor has its fee structure. The payment processor markup is a term that describes the additional fee charged by payment processors, which can differ based on their pricing plan.

In choosing a payment processor, there are several factors to consider. Do your due diligence by comparing your options before making a decision. Some key considerations include transaction fees, processing speed, security features, and customer support. Consider your options carefully before choosing a credit card processor that will help streamline your payment processing and provide a positive experience for your customers.

The credit card processor you choose for your business holds equal significance as the banks you collaborate with. A reliable payment system is crucial for any business, be it a restaurant, hair salon, or retail store. The institutions and service providers supporting your payment systems must be robust and dependable. However, accepting credit card payments involves more than just the transaction fees and the types of cards that can be processed. For small business owners, the ideal credit card processor offers dependable, secure, cost-effective services requiring minimal attention.

Copyright © 2025 Financial Services Review. All rights reserved