Financial Services Review: Specials Magazine

It is clear that the financial services industry has always experienced change, and navigating that change has been at the heart of Money Concepts since its beginning in 1979. Money Concepts’ founder, John P. Walsh, was an innovator with the vision to break through the industry’s “norms” and establish a revolutionary approach to delivering financial services to Main Street. His vision broke down traditional silos in which professionals experienced proprietary constraints, biased research, and a captive structure with limitations. This new approach opened the door for financial professionals to provide top-tier solutions with a comprehensive delivery, addressing needs in a consultative manner that focused on the total well-being of the client, and not based on a limited scope of work.

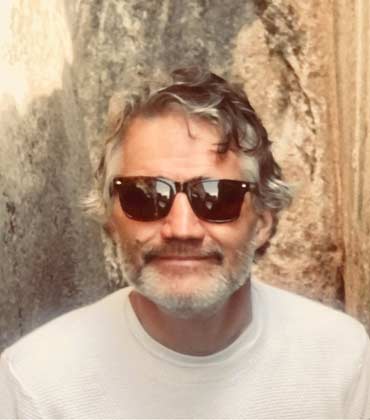

That vision served as the foundation of Money Concepts and is alive and thriving today under the leadership of Denis Walsh, President and CEO. Unlike many second-generation owned firms, Denis has taken the success of the past and has used the rich traditions to propel forward. Today, the community of likeminded professionals at Money Concepts experiences a Culture of Sharing to continue its growth.

“It starts with culture, and at Money Concepts, we lead with

Alternative Investment 2025

Ares Management Corporation (NYSE: ARES) is navigating the risk and returns in the world of alternate investments by orchestrating financial solutions for clients that go beyond mere traditional asset management. By making bold yet calculated plays that deliver long-term value and constructing resilient investment structures, the company consistently contributes to revitalizing distressed assets and accelerating the growth of mid-sized enterprises. Trusted stewards of scalable and flexible capital for nearly three decades, Ares has grown into a global alternative investment manager with footprints across North America, Europe, Asia Pacific and the Middle East. Since its inception, the company has generated cycle-tested performance for investors by offering them primary and secondary investment solutions across credit, private equity, real estate and infrastructure. One of the reasons why Ares stands as an unassailable leader is due to its value-oriented investment strategy. By targeting assets with a history of stable cash flows and identifiable growth prospects through intensive due diligence and disciplined portfolio management, the company meets the full spectrum of its clients’ financing needs. In a market long fixated on public equities, Ares has built a reputation in private credit as an experienced evaluator. Its credit group manages over $348.8 billion and uses bottom-up research to identify investments that deliver attractive relative value compared to their fundamental credit risk profile. The division offers a spectrum of investment solutions, including syndicated loans, high-yield bonds and alternative credit investments, to give companies directly originated fixed and floating-rate credit assets. This strategy diversifies traditional fixed-income portfolios and enables investors to capitalize on liquidity premiums across the credit spectrum. “There is a pretty significant intersection between credit and insurance. Putting more senior resources and attention on driving organization design and performance there will be a big benefit,” says Michael Arougheti, CEO and president.

Investment Management Software 2025

The global financial system doesn’t rest. Markets open and close across time zones, trillions of dollars move in real time and trades are executed in the blink of an eye. Investors demand transparency, regulators demand compliance and institutions demand precision. In this high-speed, high-stakes environment, even the smallest operational failure can ripple across the world. Operating quietly behind this complex ecosystem is SS&C Technologies. It isn’t a bank. It doesn’t manage capital or custody assets. Instead, it delivers the technology and services that make those activities possible. It is the unseen infrastructure that keeps the financial world moving with confidence. SS&C is a global provider of mission-critical, cloud-based software and services for the financial services and healthcare sectors. As an investment operations partner, it supports the end to-end activities that institutions rely on—from trade execution and reconciliation to fund administration, regulatory reporting, performance analytics and investor servicing. These are not just back-office tasks. They are core operational functions that determine whether capital flows efficiently or grinds to a halt That’s SS&C’s value proposition. It doesn’t compete with its clients but empowers them. From hedge funds in Manhattan to insurers in Tokyo, over 20,000 organizations across over 100 countries rely on SS&C to manage the operational complexity they can’t afford to get wrong. Its platforms and global service teams work in tandem to ensure precision, scale and speed at every turn. At its core, SS&C manages how assets move through the financial system. Its integrated platforms and outsourcing services streamline everything from compliance tracking and NAV calculations to investor communications and performance attribution. The result? Clients stay focused on generating returns and managing risk, while SS&C ensures the operational engine runs reliably in the background. “Leaders need to understand—this isn’t someone else’s money. It’s our money, and it should be treated with that level of care and accountability. If you don’t, you’re simply going to earn less,” says Bill Stone, founder and CEO.

CXO INSIGHTS

Engineering Trading Systems - Challenges and Opportunities

Denis Imaev, Managing Director, Head of Algorithmic Trading Development, Cantor Fitzgerald

The First of Many Lessons from FTX

Blue Macellari, Head of Digital Assets Strategy - Global Trading, T. Rowe Price

Latest Trends in Investment Management

Darrell Van Amen, Executive Vice President & Chief Investment Officer, HomeStreet Bank

Building Resilient Supply Chains Amid Economic and Geopolitical Uncertainty

Joao Galvao, Managing Director - Head of Transaction Banking Corporate Sales, Americas, Standard Chartered Bank

Credit Risk As Customer Service

Clayton Dexter, Underwriting Manager, Vice President, ANB Bank

How to Make Innovation Everyone's Mission?

Roben Dunkin, Chief Innovation Officer, PGIM

Smart Enterprise Adoption of Generative AI

David Robertson, Director Enterprise Architecture - Software Engineering Applications, Exeter Finance

IN FOCUS

Fintech Evolution: Harnessing AI and Blockchain Technologies

AI and blockchain are revolutionizing fintech by enhancing efficiency, security, and accessibility, transforming financial services and fostering inclusion.

EDITORIAL

Tech-Driven Transformation in the Broker-Dealer Ecosystem

The broker-dealer space is experiencing unprecedented momentum, with record trading volumes, rising client demand, and expanding revenue streams across both retail and institutional segments. Much of this growth is being fueled by rapid advances in technology, particularly in automation, data analytics, and digital client engagement.

From AI-driven compliance tools to API-enabled trading infrastructure, today's broker-dealers are leveraging innovation not just to keep pace with regulatory demands but to redefine client experience and operational scale.

Cloud-native platforms are also gaining traction, offering broker-dealers the scalability and resilience needed to manage increasing data volumes, streamline operations, and enhance disaster recovery capabilities in a highly regulated environment.

Another trend reshaping the industry is the rise of embedded finance, which allows broker-dealers to integrate investment and trading services directly into non-financial platforms—extending reach and enabling frictionless access to financial products.

The use of advanced behavioral analytics is also helping firms better understand investor behavior in real time, allowing for hyper-personalized services and proactive risk mitigation.

This edition of Financial Services Review brings recent developments in the broker-dealer ecosystem into sharp focus, highlighting the technologies driving operational agility, the strategic responses to evolving client expectations, and the regulatory shifts shaping tomorrow’s business models.

It features thought leadership articles from industry experts, including Colin Kinney, senior vice president, global chief compliance officer of Virtus Investment Partners, who shares insights on strengthening compliance frameworks, preparing for regulatory exams, and aligning data governance with evolving SEC expectations. Gilbert Asamoah, credit risk manager at NiSource explores what makes financial risk management truly effective, emphasizing the importance of aligning technical risk practices with organizational strategy and viewing risk management as a dynamic, iterative process.

We hope this edition offers valuable perspectives and practical guidance for industry leaders navigating a rapidly evolving financial landscape.