Financial Services Review: Specials Magazine

TekProvider delivers a robust software platform for commercial and consumer lending, equipment finance, and leasing. Tailored for financial institutions of all sizes, it provides end-to-end solutions that automate and streamline operations for loan origination, loan collection, contract and asset management and servicing, workflows and regulatory compliance. Flexible deployment options—on-premise or cloud-based—ensure seamless integration, enabling institutions to manage lending and leasing efficiently across diverse financial products and processes. TekProvider’s platform drives significant cost savings and operational efficiency by automating lending and leasing processes, reducing manual errors and accelerating loan cycles. Clients benefit from improved risk management, optimized and automated workflows and reduced manual tasks, speeding up transaction cycles. Enhanced regulatory compliance reduces risk, while scalable solutions boost productivity. These improvements boost the bottom line, allowing financial institutions to focus on customer service and expansion rather than administrative burdens. With 30 years of expertise, TekProvider excels in implementing and customizing solutions for diverse financial institutions. Its professional team of experts collaborates closely with clients to tailor the platform to specific needs. This ensures seamless integration and optimal performance, while also providing training and ongoing support to minimize disruptions and maximize value. The extensive experience also enables addressing complex challenges in lending and leasing, delivering reliable, scalable solutions that empower clients to achieve operational excellence and meet evolving market demands. Global business leaders like Nissan, BMW and Santander rely on TekProvider for their critical lending and leasing operations. TekProvider’s proven platform, with its robust features, ensures these industry giants achieve operational efficiency and positive impact on their bottom line. The trust placed in TekProvider reflects its ability to deliver functionally rich, scalable and tailored solutions that meet complex and rigorous demands of global financial institutions. Among its strengths, TekProvider is a leader in the automotive finance sector, offering specialized solutions that streamline lending and leasing for auto finance global brands. Its platform supports end-to-end processes, from loan origination, including account onboarding, to contract servicing, enabling automotive financiers, captive and independents alike, to expand operations in regions like Latin America and elsewhere. With tailored auto loan and leases solutions, TekProvider helps clients scale efficiently, enhance customer experiences, and capitalize on growth opportunities in the competitive automotive finance market.

Cross Border Payment Solution

The cross-border payment industry is entering a new era. The landscape is no longer unidirectional; it encompasses everything from refunds and discounts to salaries and expenses. This adds layers of complexity, making fast and secure transactions more difficult. Payouts, which are already challenging on the national level due to verification and security demands, have become a tricky maze on an international scale. Success in the domain requires integrating advanced technology, understanding local insights and building strong stakeholder relationships. Operating as a product focused technology company, D24 stands as a premier payments solutions provider. It is enabling companies to gain access to more than 27 countries across APMS and card processing through a singular API. Established in 2009 during rapid growth in non-cash payments worldwide, the company has 15 years of expertise in pioneering international, cross-border payment solutions. Today, it is recognized as one of the fastest-growing multi-market payment solution providers with some of the best conversion rates in the market. “Our mission is to simplify payments for businesses and individuals worldwide, no matter where they happen to be, such that you can focus on your business while we handle EVERYTHING else,” says Veronica Pinazo, Chief Operations Officer of D24. “We deal with the complexities and regulations that apply to customers in all markets, providing user KYC identity verification, mapping of local databases and fraud prevention. It’s our capacity to adapt to the requirements of each different country which excels our home-field advantage.” D24 develops tailored payment gateways and provides extensive payment processing solutions, encompassing card payments and alternative payment methods (APMs) for merchants. Leveraging its deep understanding of emerging markets, D24 enables merchants to operate globally without local establishment, tapping into regional expertise and knowledge base. The company supports over 260 payment methods worldwide, accessible via a single API for seamless integration across various countries.

Fintech Solution

In the heart of Mexico, albo, a leading neobank, is making waves with its pioneering efforts to bring millions of individuals and businesses into the fold of digital banking. In a country where nearly half the population lacks access to basic financial services, albo is bridging the gap that traditional banks and fintech players have struggled to close by democratizing finance. Through its distinct B2B2C strategy, albo is empowering business owners of all sizes, from small enterprises to large corporations, by offering a comprehensive suite of debit, credit and payment products that enhance operational flexibility. “Our B2B2C strategy creates a beautiful cycle, providing business owners and their employees with access to the financial system,” says Angel Sahagun Fernandez, CEO. albo goes beyond simplifying banking to address longstanding challenges for Mexican businesses. Traditional banking and poor customer service often create operational hurdles. albo eliminates these issues by facilitating rapid business operations through an out-of-bank account setup, enabling immediate receipt of customer payments. Businesses can issue accounts and cards to employees in under five minutes. Efficient Payroll management is a top priority for albo. In Mexico the process presents a significant challenge, especially blue collar industries whose workers are typically excluded from the financial system. albo’s innovative payroll platform enables businesses to effortlessly manage payroll and make disbursements directly into employees’ albo accounts—all free of charge. This streamlined process eliminates the time-consuming procedures typically associated with payroll setup, ensuring seamless and compliant payroll operations.

CXO INSIGHTS

Evolving Trends In the Fintech Industry

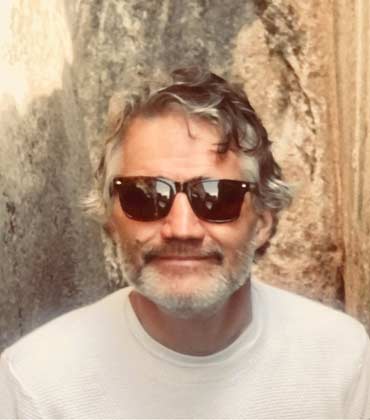

Joyce Saika, VP Finance, IR and Legal, Nuclea

Tax Reform

Vanessa Ferreira Lukaisus, Tax Director, GM Financial

The Hyper personalization Revolutionizing the Credit Collection Industry

Luiz Gustavo Gava, Executive Director Collection, PicPay

Latest Trends in Investment Management

Darrell Van Amen, Executive Vice President & Chief Investment Officer, HomeStreet Bank

Building A Resilient Credit Portfolio For Economic Uncertainty

Filipe Matzembacher, Director - Head of C&A Pay, C&A Brasil

Promoting Technology Adoption in the Managed IT Sphere

Humberto Morales, Regional Technology Operations Manager, Marsh McLennan

Dos and Don'ts of Exposing Services

Humberto Enriquez, Director of Software Engineering, Actinver

IN FOCUS

Driving Efficiency and Compliance in the Financial Sector

Financial institutions are enhancing their cybersecurity frameworks with multi-layered protection, behavior-based anomaly detection, and real-time monitoring tools.

Digitizing Finance: Transforming Operations Across Latin America

Financial platforms in Latin America enhance efficiency and transparency through automation and real-time insights.

EDITORIAL

A New Era for Latin America’s Digital Finance

Latin America is rewriting its rules of finance. Across the region, banks, fintechs, and investors are moving with fresh urgency, fueled by the rapid rise of digital platforms, new open finance regulations, and growing confidence in the region’s potential. What once felt experimental has become a defining force in financial transformation.

From Mexico City to São Paulo, financial institutions are rebuilding from the ground up. Outdated systems are being replaced with flexible, data-driven platforms. Digital payments are becoming effortless, and artificial intelligence is helping create smarter, more accessible financial services. The goal is simple: to make finance faster, fairer, and more connected.

Progress, however, brings its own challenges. Each country operates under different regulatory rules, making regional integration a complex task. Legacy systems and fragmented data continue to hold institutions back, while maintaining compliance and trust remains a constant test.

Even with these hurdles, optimism is growing. Brazil’s open finance success shows what can happen when clear governance meets bold innovation. Its progress is inspiring other markets to move faster and attract new investment. Capital is flowing into platforms that power real-time payments, smooth regional transactions, and greater access to credit for people and businesses long left out of the system.

As 2025 unfolds, Latin America is not following the global fintech story. It is writing its own, with technology, inclusion, and resilience at its core.

In this edition, we feature several influential names and their perspectives on the current situation and the upcoming opportunities in the market. We include insights from Cléber Alexandre Agazzi, Head of Infrastructure & IT Operations at Sicredi and Carlos Francisco Silva Ortiz, Head of Data & AI, Skandia Colombia, who offer a deeper look into the workings of their organizations and their role in it. We believe their insights will help you make better and more data-driven business decisions.