Financial Services Review: Specials Magazine

Walk into the offices of Access Receivables Management, and it’s immediately clear: this is not your typical collections agency. Here, there are no cold calculations, no dispassionate call centers. Instead, there’s a palpable sense of purpose—a shared understanding that success is measured not just in dollars recovered, but in trust earned and relationships built. Since opening its doors in 1999, Access Receivables Management has rewritten the narrative around debt collection. Built on the simple but powerful idea that clients deserve full, unfettered access to their information, the company has grown into a trusted partner for a wide range of industries. Its client portal—offering real-time visibility into accounts— stands as a symbol of that commitment. In fact, the founders chose the name "Access" to underscore the company’s philosophy: transparency is not an add-on—it’s the foundation. Today, leading the charge are Senior Vice President and Chief Operating Officer Rae Lockard, Vice President of Operations Tim DePetris, Administrative Manager Melissa Lintz, and Vice President of Finance Tillesa Coleman. Together, they have created a workplace and client experience that elevate Access beyond the traditional image of a debt collection agency. A Culture That Fuels Excellence At the heart of Access Receivables is a culture of stability and respect—one that has kept the team together for decades. Many employees, including Lockard, DePetris, Lintz, and Coleman, have worked with the company’s founders since the 1990s. Their loyalty speaks volumes about the environment they’ve helped shape. “We're not just employees filling roles,” Lockard shares. “We are empowered professionals. Our contributions are recognized, our ideas respected. That sense of trust shows in how we serve our clients.” This culture of empowerment creates a direct, measurable impact. Employees who feel valued take pride in their work—and that pride translates into stronger client relationships. At Access, departments don’t operate in silos; instead, they collaborate as one cohesive team.

Top Bookkeeping Service 2025

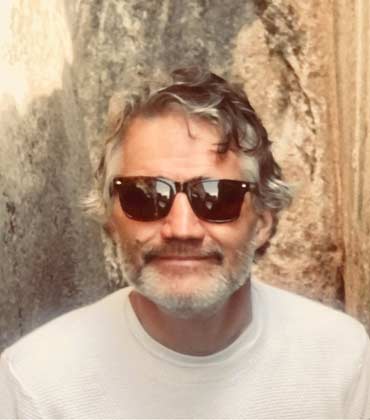

Jean Pierre Bassi Bikai had a lifelong dream of building a CPA firm that delivers reliable, high-quality services. Driven by self-determination and perseverance, he earned his CPA license and turned that dream into reality by founding Bass Accounting & Tax Services in 2012. From day one, he focused on earning client trust through consistent service rather than relying on marketing gimmicks. The result—steady, organic growth fueled by client referrals. Today, Bass Accounting & Tax Services specializes in accounting, bookkeeping, tax preparation, auditing and business consulting. It caters to individuals, small enterprises and nonprofit organizations, each with unique financial requirements. Bass Accounting & Tax Services' commitment to accessibility and client responsiveness is unmatched. Its highly personalized services are supported by flexible, transparent fee structures and consistent, direct communication. The firm builds relationships founded on trust, continuity and genuine client care, prioritizing lasting partnerships over rigid formalities. Its team guarantees prompt support, going beyond standard business hours to solve clients' queries. “Our primary goal is to help clients achieve their goals and deliver 100 percent satisfaction,” says Bikai, CEO. “By providing end-to-end financial services and managing all their financial records, we enable them to focus entirely on their core business.” Business finance consulting is another key strength of Bass Accounting & Tax Services. Operating on a month-to-month bookkeeping model, the firm delivers continuous financial oversight and strategic support. It leverages QuickBooks Online to give clients real-time access to their financial data, empowering them with the knowledge and tools to interpret key financial statements like balance sheets, profit and loss accounts and cash flow reports. This empowers them to remain in control of their business even when day-to-day accounting is fully outsourced. Its in-house team members are certified QuickBooks ProAdvisors adept at resolving software challenges, setting up accounting frameworks and ensuring that clients effectively use the platform. Inconsistencies or errors are promptly corrected and explained to assist clients in better understanding their financial posture and gaining greater confidence in their planning and decision-making processes..

Wealth Management Service 2025

At Castle Rock Wealth Management, clients are not just account numbers—they are family. Its advisors act as personal financial guides committed to understanding each client’s unique journey and providing personalized, realistic investment management. It tailors every strategy by deeply diving into clients' past and present investment experience and financial needs. This care is backed by its team of advisors who apply strategies such as Castle Rock’s proprietary snowman theory and distinct data-driven engagement to safeguard client portfolios. “Instead of merely sending monthly statements, we take the time to educate and guide our clients through market trends and investment theories, so they truly understand how their money works for them,” says Jennifer Mitchell, MPP, CWS®, Senior Financial Adviso In a market crowded with providers offering one-size-fits-all solutions, Castle Rock’s approach stands out for its attentiveness and adaptability. Many of its clients come in overwhelmed by complex, unsuitable investment plans or unsure how to handle market volatility or economic uncertainty. The firm’s data-driven process is specifically designed to simplify these complexities. It combines insights from personalized client meetings with the guiding principles of the snowman theory. A simple yet powerful analogy developed by Mitchell in 1996, the snowman theory makes the investment process clear. It provides a visual and practical structure where the base represents a client’s original investment; the body is created over time with gains earned through asset growth and the head is formed by accumulating income from the base and body of the ‘snowman’ as a client nears retirement.

CXO INSIGHTS

Sustainability through Business: A New Way Forward

Shaun Taylor, CFO, Americas, Standard Chartered Bank

Navigating Software Development in the Financial Industry

Denis Imaev, Managing Director, Head of Algorithmic Trading Development, Cantor Fitzgerald

Latest Trends in Investment Management

Darrell Van Amen, Executive Vice President & Chief Investment Officer, HomeStreet Bank

Insights from NatWests Head of US Sales & Trading

Casey Spezzano, Head of Customer Sales and Trading, US, NatWest

The Evolving World of Corporate Strategy and Finance

Felipe Izquierdo, Strategic Finance Lead, Remitly

Effective Financial Risk Management

Gilbert Asamoah, Credit Risk Manager, NiSource

Navigating the Evolution of ERP: Business Objectives, Research Extensions, and Digital Debt Management

Alfred Zhu, VP of Digital Technologies, The Middleby Corporation

IN FOCUS

Bookkeeping in the Digital Age: Trends and Innovations

The bookkeeping service industry is evolving through technology, automation, and outsourcing, transforming from a back-office function to a strategic asset that enhances financial accuracy, compliance, and overall business efficiency.

Optimizing Debt Recovery through Technology and Consumer Engagement

Businesses can adapt to changing market demands while ensuring their growth benefits a broader audience, reinforcing the importance of social responsibility in the corporate world.

EDITORIAL

Reinventing Back-Office Essentials

In an era defined by automation, data security, and ethical customer engagement, the back-office staples of bookkeeping and debt collection are undergoing a transformative evolution. These once-manual, compliance-heavy services are becoming high-tech, intelligence-driven powerhouses—essential to sustainable business growth.

Bookkeeping, traditionally focused on transaction tracking and financial recordkeeping, has shifted to a strategic advisory role. Thanks to cloud accounting platforms like QuickBooks Online and Xero, businesses now have real-time visibility into their financials, facilitating smarter decisions and better cash flow planning. The integration of AI and blockchain has boosted accuracy, streamlined anomaly detection, and introduced triple-entry systems for enhanced security. Notably, bookkeepers are now advising on ESG (Environmental, Social, and Governance) reporting, helping businesses align their financial practices with sustainability goals.

Security is also a rising concern. With financial data moving online, cybersecurity protocols and AI-driven threat detection are becoming standard. Bookkeeping professionals today are expected to blend financial acumen with tech-savviness, ensuring resilience in a fast-paced digital landscape.

Meanwhile, the debt collection industry is shedding its stigma. In 2025, the focus is on empathetic, consumer-centric approaches that prioritize transparency and respect. AI-powered analytics and predictive modeling are enabling firms to assess repayment probabilities more accurately, while digital-first strategies like chatbots, SMS, and self-service portals are improving recovery rates by over 30 percent.

The shift is evident globally. India’s Credgenics, a digital-first recovery platform, tripled its profit in FY25, highlighting growing demand for automated, ethical solutions. PSU banks in India are also collaborating on a shared debt recovery platform for MSMEs, aiming to standardize and streamline collection practices. Internationally, regulators like the UK’s FCA and the U.S. CFPB are cracking down on aggressive tactics, pushing for fairer, more regulated collection models.

This edition of Financial Services Review explores how bookkeeping and debt collection are no longer just support functions—they are strategic, tech-enabled pillars of modern business. It features insights from Blue Macellari, Head of Digital Assets Strategy - Global Trading, T. Rowe Price and Steve Harris, SVP Chief Ethics & Compliance Officer and Head of Employment Law, Lincoln Financial Group. They highlight new financial technology solutions and how they have continued to emerge, enabling businesses to increase automation, create efficiencies and enhance the customer experience.